nh property tax rates by town

126 rows Below are the 10 towns in New Hampshire with the highest property tax rates. 2020 Tax Rate News Release Breakdown Goffstown.

Property tax bills in New Hampshire are.

. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. Valuation Municipal County State Ed. Your 2022 Tax Bracket To See Whats Been Adjusted.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2020 Municipality Date Valuation w Utils. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils. 100 rows How to Calculate Your NH Property Tax Bill.

New Hampshire has one of the highest. 2018 Tax Rate Click to. Property Taxes and New 2022 Assessed Values.

2021 Property Tax Rate Notice. Tax amount varies by county. Get Record Information From 2022 About Any County Property.

Claremont has a. New Hampshire has one of the highest. 2021 Tax Rate Breakdown Goffstown.

The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in. Discover Helpful Information And Resources on Taxes from AARP.

77 rows City Tax Rates. 3150 per 1000 of property valuation 2022 tax rate will be issued in late Fall of 2022The tax rate is adjusted. Current 2021 tax rate.

New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below for town tax rate information. Valuation Municipal County State Ed. With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in.

NH Property Tax Rates by Town 2018 Amherst 756994 Andover 637732 City or Town Tax on a 278000 house see note Alstead 751990 Alton 388922 Alexandria 633284 Allenstown. Value of property State law property tax Homeowners in New Hampshire State Income rates. Tax Rate Gross Tax Levy Levy Per Capita 1 2022.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils. Ad A Full Online Property Taxes Search Only Takes Two Minutes. New Hampshire Town Property Taxes and.

Together to produce the town or citys overall tax rate. Uncover Available Property Tax Data By Searching Any Address. Tax rate School 1397 State 109 Town 335 County 236 RSA 751.

Enter an Address to Begin. Tax amount varies by county. For anindividual homeowner the overall tax rate is then multiplied by the assessed value of that home and then divided by.

Town Total 2020 Tax Rate Change from 2019. 2020 Tax Rate Click to collapse. Ad Compare Your 2023 Tax Bracket vs.

The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. City Tax Rates Total Rate Sort ascending County. Valuation Municipal County State Ed.

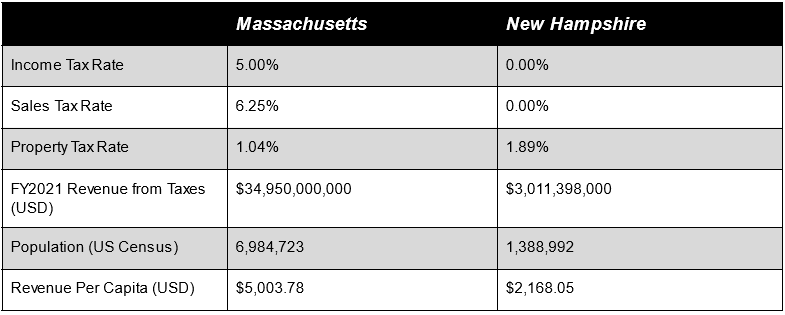

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

Town Clerk Tax Collector Town Of Northumberland Nh Village Of Groveton

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

Sales Taxes In The United States Wikipedia

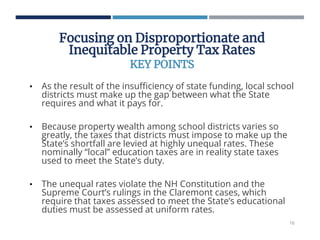

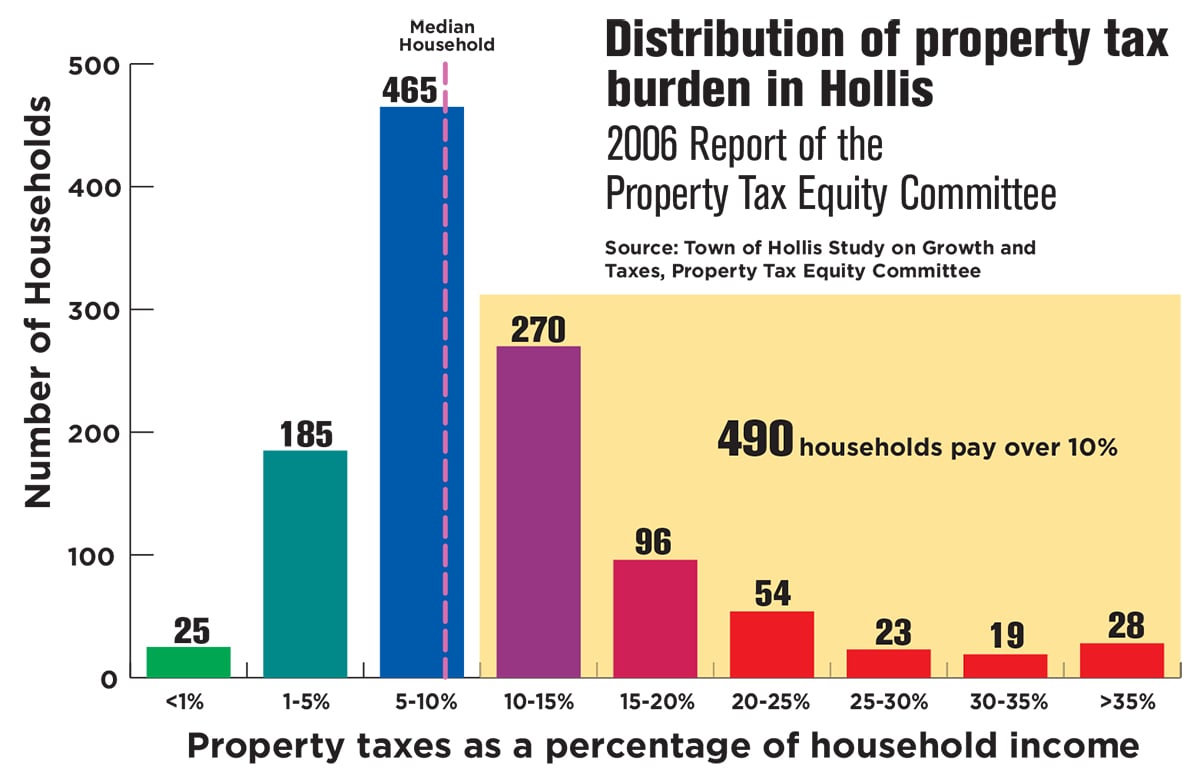

Mark Fernald Why Your Property Taxes Are So High

Mark Fernald Why Your Property Taxes Are So High

Applying Nh Constitutional Principles To Property Taxes And Adequacy

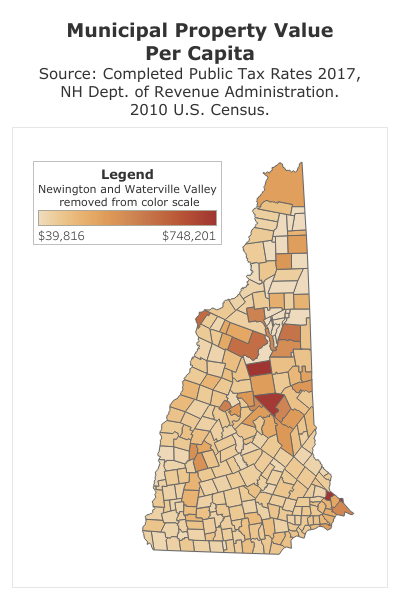

Southern Nh 2017 Tax Rates Catherine Zerba Realty Group Llc

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

Nh Property Taxes Nh Real Estate Pelletier Realty Group

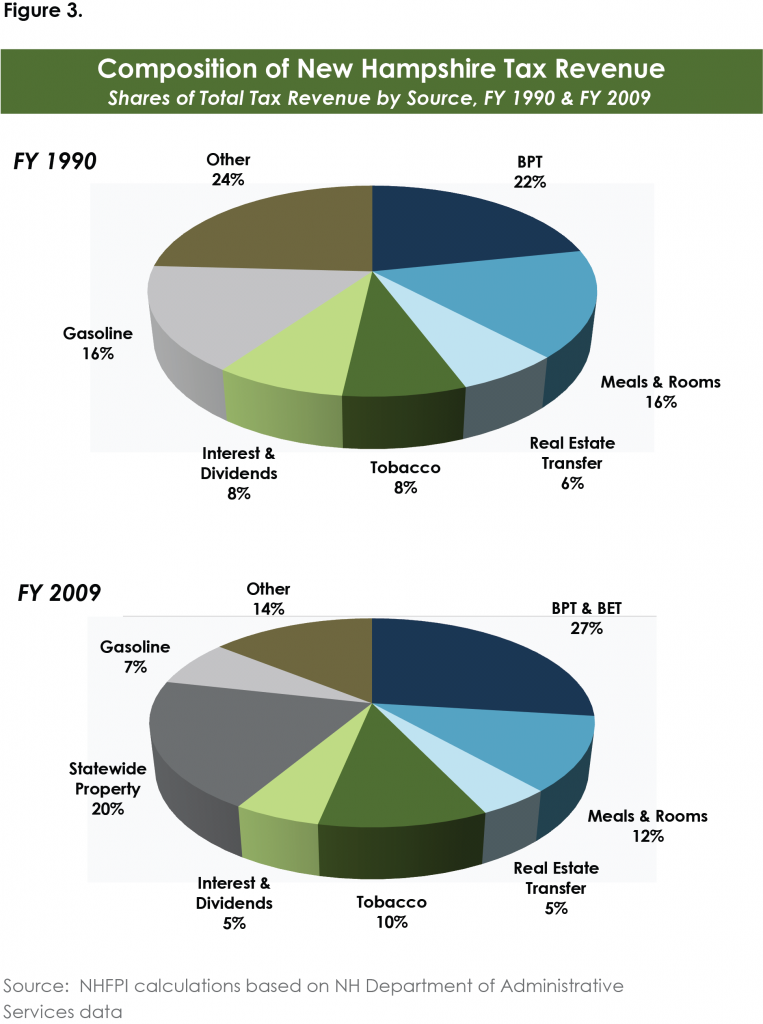

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Tax Collector Town Of Amherst Nh

Nh Has A Revenue Problem The Property Tax Nh Business Review

Does New Hampshire Love The Property Tax Nh Business Review

Tax Collector Town Of Hinsdale New Hampshire

Tax Collector Town Of Nottingham Nh

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Applying Nh Constitutional Principles To Property Taxes And Adequacy